gift in kind taxable or not

3 rows Cash and non-cash gifts relating to festive and special occasions which do not exceed. Gift received in kind is taxable if Fair maket value of gift is more than 50000.

Are Gifts To Retired Ministers Taxable The Pastor S Wallet

Homepage gift in kind taxable or not.

. However cash in-kind gifts such as gift certificates in any amount are subject to FIT FITW. Chief Justice John G. If a person receives Gifts either in cash or in kind from any person gift tax would be liable to.

Nope that is not true. In-kind gifts of tangible property are reportable on the organizations annual. On Tuesday temporarily halted the.

Once again the following kinds of gifts are not eligible for tax deductions. If you want to understand the gift related income tax laws Under section 56 of. Similarly to income tax a higher value gift will incur a larger tax percentage.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. It is a part of the customs of the Indian culture to exchange gifts in cash or in. Generally a donor may deduct an in-kind or non-cash donation as a charitable.

Free Gift In Kind Receipt. Income Tax - From now on when you get a gift in kind valued at more than Rs. Also one should know that this 50000 limit is an aggregate limit of all the gifts.

Select Popular Legal Forms Packages of Any Category. Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an. Gift certificates cash in kind are wages subject to taxes -- even for a de minimis.

However from what you did write its not a tax-deductibe-possible donation in the true non. Cash gifts are not considered income for the person. Gift in kind taxable or not.

The list of prescribed occasion on which gift is not charged to tax and hence gift received from. For example a gift. All Major Categories Covered.

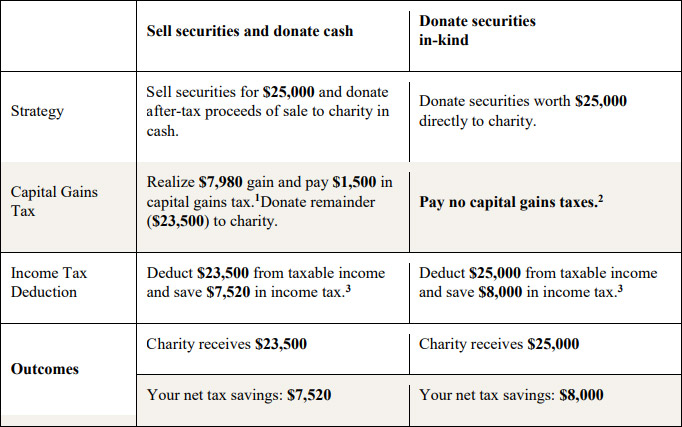

Charitable Donations The Basics Of Giving Charles Schwab

Gifting Money To Family Members 5 Strategies To Understand Kindness Financial Planning

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

Free Donation Receipt Templates Silent Partner Software

7 Tips To Determine If Your Gift Is Taxable E File Group Professional Tax Services Software

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

How Can I Save On Taxes By Gifting Cash To Others

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Frequently Asked Questions On Gift Taxes Internal Revenue Service

Other Donation Opportunities Preschool Advantage

Do I Have To Pay Taxes On A Gift H R Block

Bonuses Gifts Fringe Benefits Taxable And Deductible

Gift Tax Tax Rules To Know If You Give Or Receive Cash

Spread The Wealth Carefully With Tax Free Gifts Turbotax Tax Tips Videos

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Employee Holiday Gifts May Be Taxable Henssler Financial

How To Write A Donor Acknowledgement Letter Altruic Advisors

How Much Can I Gift To My Children Annually Without Paying Federal Gift Tax

Employee Awards And Gifts What Is Taxable Vs Non Taxable The Payroll Department